Bitmex is the best exchange if we want to trade with leverage in specific Cryptocurrencies and you can find herethe best Bitmex Tutorials that our team has found.

Don’t forget that leverage trading is indeed very very risky.

If you are searching for a complete Bitmex Tutorial with great detail of explanation, for newbies you can watch one Bitmex Tutorial here.

Understanding the Basics of Leverage trading and Bitmex tutorial

There is a huge number of Crypto Traders who are not aware on how to set correct Take Profit & Stop Limit.

This short video will explain the correct steps and the benefits which are outstanding.

95% of the traders do not know how to use correct leverage.

This 3 minute video will enlighten the right way to use leverage on Bitmex.

It has been presented by good examples and humor for any new trader to easily understand.

If you want to understand the meaning of Leverage Training you may check the article at Investopedia.

Bitmex exchange for cryptocurrency margin trading

Another advantage is that the exchange enables us to make short trades, it suggests profit when Bitcoin decreases.

It is necessary to keep in mind that margin or leveraged trading is thought about very dangerous and speculative, so you must trade with care.

Always trade amounts you pay for to entirely lose.

Margin trading is not suitable for newbies in trading and must be made with mindful caution and attention.

Somebody using the info provided in this video or post, consisting of purchasing or selling, does it on his/her own danger.

There is a significant benefit in margin trading.

We can in fact leverage a position without the requirement to hold the needed bitcoin or crypto possessions.

In the cryptocurrency world, it is not recommended to hold a big quantity of bitcoins on an exchange.

Better to hold them just on freezer.

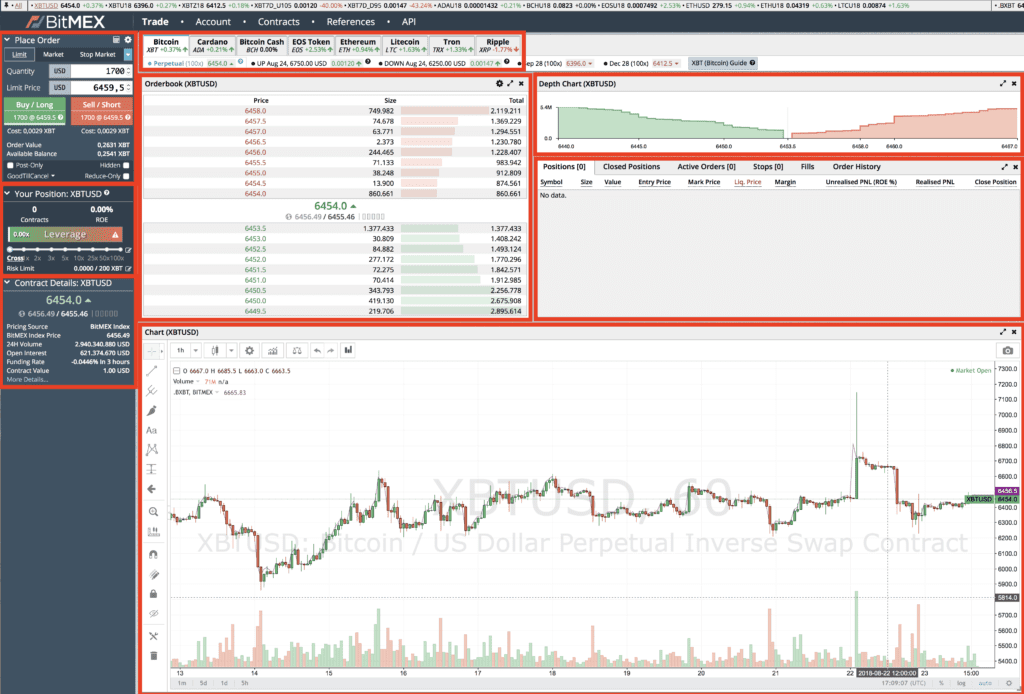

The BitMEX primary screen

- Quantity = position size in United States dollars.

As you can see on the right side we see the last transactions made, in the middle we have the graph

The left pane is actually the intriguing one, here we open our positions.

- Limitation Price = The price we set in order to open the position

- Expense = the overall rate of the position

Another thing you need to know about is the liquidation cost.

This is the price value at which Bitmex will close the position, or liquidate it.

Bitmex can’t manage to lose!

In order not to lose the cash we obtained for the position, the position will instantly close as soon as we lose the amount of bitcoins that belongs to us.

Opening a new position

You can open a new position with BUY order, and this indicates long position.

We BUY (long position) when we think that the value of Bitcoin will increase

On the other hand we SELL (short position) when we actually gain from the decline of the Bitcoin’s value.

Leverage means position expense divides by the very same ratio.

If we set the leverage to be times 5, then we expect the expense of the position to be minimized by the exact same ratio– divided by 5.

Or if we desire to close the position instantly– there is this red button here – Market.

The order will be launched to the marketplace and will close at the very best available price.

On Bitmex there are advanced choices such as stop-limit.

We will set the buying rate to be greater than the marketplace cost because we want the position to open right away.

Or lower than the market cost if we desire to join the buy wall and wait on a seller.

- Available Balance = Balance we have in bitcoin.

The link here provides you a 10 percent discount rate on deal charges for the very first 6 months.

Now we see our position:

Here we can see the entry cost, Unrealized PNL is the estimated earnings and it’s determined according to this Mark Price.

You can also see the genuine Liquidation Price.

In case we close part of the position, we will see the gain or loss on the Realized PNL tab.

2 ways for closing our position.

- Order Value = The total worth of the position (if the leverage is set to 1, then it’s equivalent to the cost minus charges).

Prior to opening the position, we will define the take advantage of.

If this is your first trade I would advise leaving it on 1, that is, without any utilize at all.

It is required to verify the position in the popping screen – notice we can see when Bitmex is approximated to liquidate the position.

The position can be untilized, without the need to hold the required bitcoin or crypto assets.

Take advantage of implies position expense divides by the exact same ratio.

If we set the leverage to be times 5, then we anticipate the expense of the position to be reduced by the very same ratio, divided by 5.

Bitmex can’t pay for your losses.

In order not to lose the cash we borrowed for the position, the position will immediately close.

It will close as soon as we lose the quantity of bitcoins that belongs to us.

Or if we want to close the position immediately– there is this red button here – Market.

The very first is by setting a SELL command: suppose we desire the position to close at rate of 3800$.

So we will create an inverted command to our original position with the exact same amount.

If you don't have an account in Bitmex, try it now!Other Articles:

- Also if you want to detect signals yourself and start trading without leverage, you can check our crypto signals tutorial here.

- And if you don’t have bitcoin and you want to start trading, check our Localbitcoins Tutorial.

Recent Comments