Unlike the stock exchange, the cryptocurrency market never ever closes and never sleeps, which can be an extremely demanding scenario for traders and even casual investors in the industry.

Users acquainted with crypto investment will also be familiar with the (joyful or sinking) sensation of awakening in the early morning to be welcomed by an enjoyable or undesirable surprise when they inspect their portfolio and see large gains or losses.

As a result of the volatility of the market, trading bots have ended up being progressively popular among traders by allowing them to stay in control of their trading at all times, with the bot not sleeping even while the trader is.

In addition, a correctly specified bot permits trades to be executed faster and more efficiently than the trader would have the ability to do manually.

Bitcoin Trading Bots Recent Popularity

The surge of popularity in cryptocurrency has also resulted in a huge boost in the number of crypto trading bots offered, either for free from open-source platforms or accredited to users in exchange for flat costs.

Nevertheless, it is difficult to ascertain which of them work as planned and which of them are an outright wild-goose chase.

This post will consider the background to what precisely trading bots are and whether they work for Bitcoin trading (and more importantly, for your Bitcoin trading).

It will then consider some of the best trading bots in the market today.

What are Trading Bots?

In essence, a trading bot is a software program that engages directly with financial exchanges (frequently using API’s to get and interpret pertinent information) and locations buy or sell orders in your place depending upon the interpretation of the marketplace data.

The bots make these choices by keeping track of the market’s cost movement and reacting according a set of predefined and pre-programmed guidelines.

Typically, a trading bot will evaluate market actions, such as volume, orders, rate, and time, although they can normally be set to suit your own tastes and choices.

Trading Bot Technique

Trading bots have been popular for lots of years in numerous traditional financial markets. Nevertheless, trading bots have actually not been generally readily available to the average financier as they cost a substantial amount of money.

For example, a Bloomberg terminal can often cost in excess of $10k. Nevertheless, due to the transparent nature of blockchain, cryptocurrency exchanges tend to grant their clients direct market gain access to that offers users with the opportunity to analyze the exchange’s electronic order book, which was a type of gain access to that was typically exclusively readily available to brokers and investment homes in conventional financial markets.

With many individuals trading Bitcoin passively and therefore not able to devote big quantities of time to evaluate the market, the objective is that Bitcoin bots will enable users to develop more effective trading without needing to continue top of the marketplace at all times.

Kinds Of Trading Bot Strategies

Although the cryptocurrency market is much less mature than other financial markets, the digital nature of the market has actually suggested that regardless of the reality that it has actually had significantly less time to integrate algorithmic trading, the innovation has not been slow in capturing up on its rivals in terms of offering a trading bot service, enabling for investors to obtain access to a large range of trading strategies, some of the most popular of which are considered listed below:

Arbitrage

In the early days of cryptocurrency trading one of the primary methods that traders used to make profits was arbitrage– i.e. buying assets in one market and then selling them in another for a greater rate, thus earning earnings on the distinction. As cryptocurrency exchanges were decentralized, there were often big differentials in between costs offered on various exchanges, implying that profits could be made through arbitrage.

Although the spread in between exchanges are much smaller sized now, they do still appear from time to time and trading bots can help users in taking advantage of these differentials. In addition, arbitrage can also be made use of in traders aiming to involve futures agreements in their trading techniques by gaining from any distinction that exists between a futures agreement and its hidden possession, by thinking about futures agreements that are traded on numerous different exchanges.

Market Making

Trading bots can also enable financiers to utilize the market making strategy.

This method offers “constant buy and offer costs on a range of area digital currencies and digital currency derivatives contracts” in an effort to “catch the spread in between the buy and sell cost”.

In order to perform the marketplace making methods, in involves making both buy and offer limit orders near the existing market location.

As prices fluctuate, the trading bot will automatically and constantly location limit orders in order to make money from the spread.

Although this may be successful at particular durations, the extreme competition around this technique can result in it being unprofitable, specifically in low liquidity environments.

Is it really true that Trading Bots Work?

Trading bots work by reacting to the market. It collects the information it needs in order to perform a trade based on analysis of the trading platform.

However, with cryptocurrency, the trading platform only informs half of the story, with numerous rises and falls being based upon other sources (such as John McAfee’s Twitter or other online reports!) that can not be configured into the bot for analysis. In addition, as noted above, the spread between the exchanges has actually flattened somewhat, meaning that the chances for inter-exchange arbitrage are much lower than in previous years.

Many trading bots use what is understood as an exponential moving average (EMA) as a beginning point for examining the marketplace.

EMA’s track market costs over a set period, and bots can be set to respond to what that price does – such as moving beyond certain thresholds.

By programming the bots, traders can set their limits to refer their danger hungers.

However, one of the downsides of EMA is that it is based upon past history, which, as all traders will understand, is not a sign of future performance, particularly in the cryptocurrency industry where volatility is swarming.

Therefore the question of whether trading bots work is a multi-faceted one in which the issue answer is that they work, but not necessarily for everyone.

Trading bots provide a variety of advantages, including having constant interaction with the marketplace, as well as the not-insubstantial factor of getting rid of the emotion from trading.

Nevertheless, on the other hand, by utilizing the wrong trading strategy or counting on the trading method of others, a trading bot might just wind up automating a set of bad market trading decisions.

Finest Crypto Trading Bots

In this area we will take a look at a few of the popular and publicly-available bots you can utilize.

3 Commas Trading Bot (The best automated cryptocurrency trading platform)

3Commas is a popular trading bot which deals with a number of exchanges consisting of Bittrex, BitFinex, Binance, Bitstamp, KuCoin, Poloniex, GDAX, Cryptopia, Huobi and YOBIT.

The bot works 24// 7 with any device as it is a web-based service so you can monitor your trading dashboard on mobile as well as desktop and laptop.

It enables you to set stop-loss and take-profit targets and likewise has a social trading aspect which permits you to copy the actions of it’s most effective traders.

Another fascinating function is it’s ETF-Like crypto portfolio function which permits you to Produce, examine and back-test a crypto portfolio and Pick from the best performing portfolios produced by others.

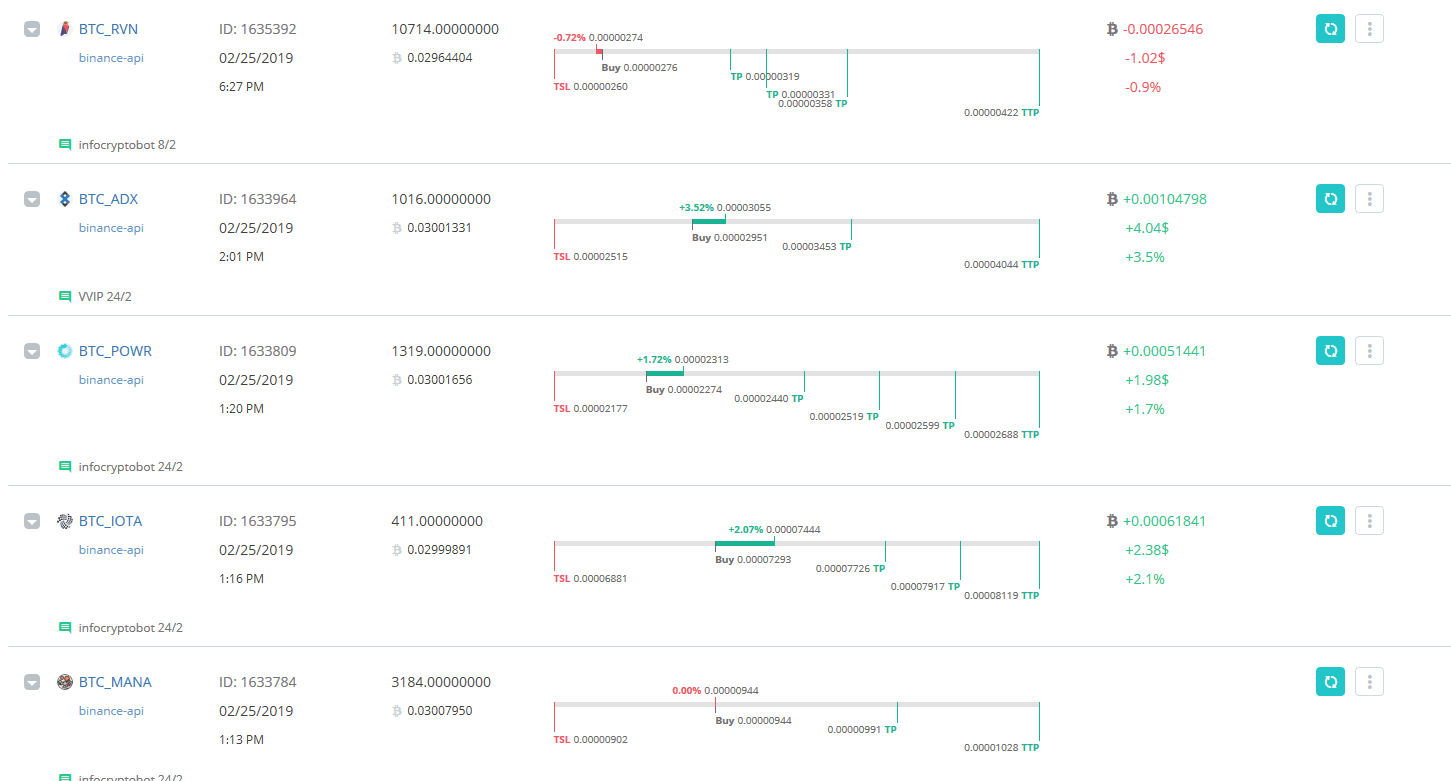

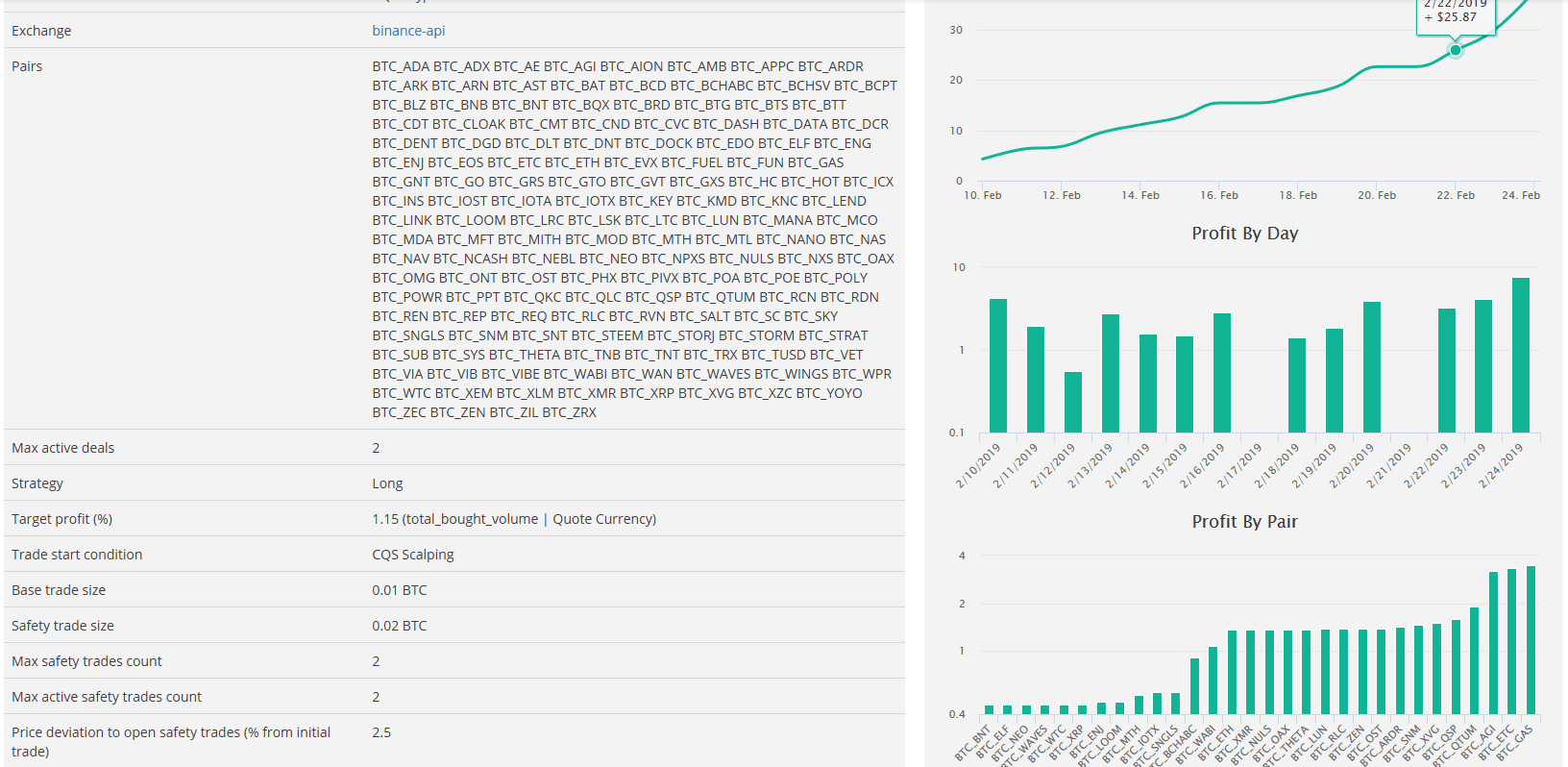

I have been working with 3commas for over a month using an automatic bot to trade in Binance and i have seen amazing automated trades in auto pilot!

For people that need an automated Trading Bot I totally recommend 3commas for an all in one solution.

Check my results after 14 days trading in auto pilot with 3commas bot.

Cryptohopper : Well Designed Cryptocurrency Automatic Trading

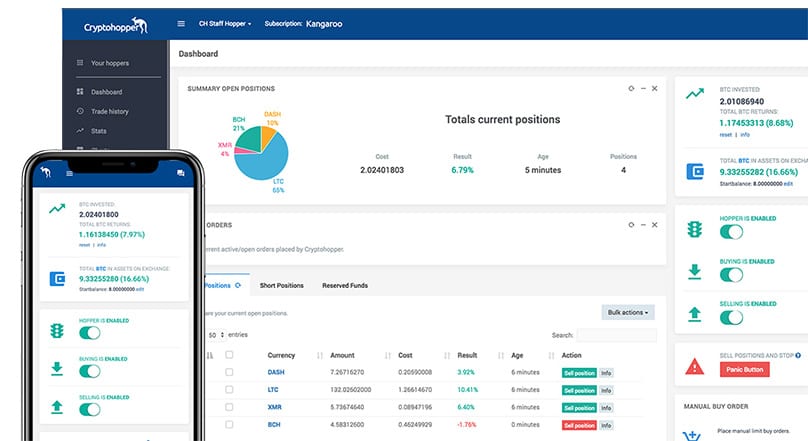

Cryptohopper is one of the most recognized gamers in the vehicle trading scene for numerous factors.

To start with, they run entirely on the cloud, so no installation is required making 24/h trading possible.

They likewise have an incredibly instinctive control panel, and just require a 5 minute set up to begin trading.

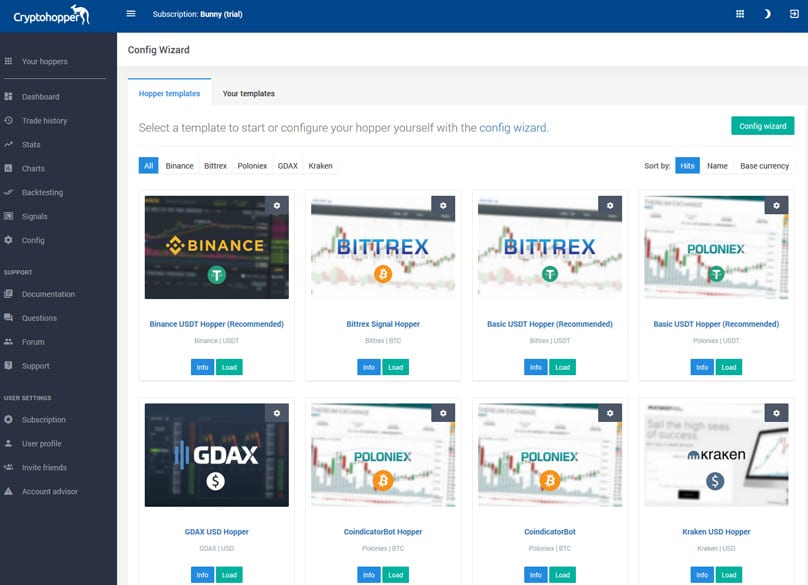

Cryptohopper Dashboard

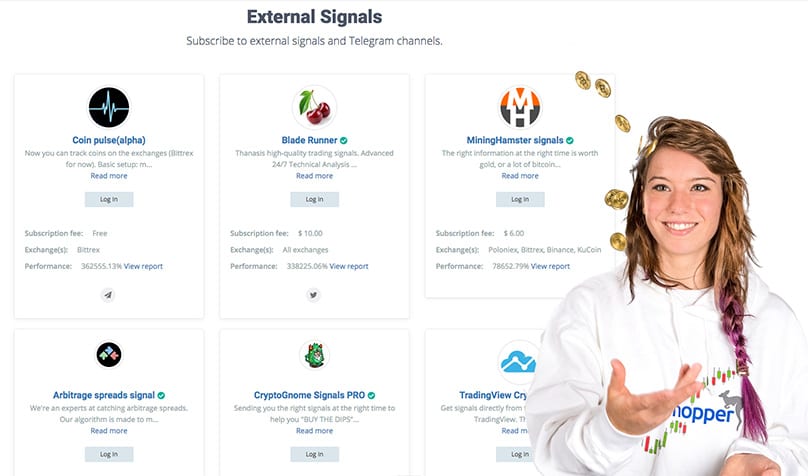

Next to this they are the only bot to embed external signalers, enabling new traders to sign up for a growing list of expert experts from worldwide.

Many usage maker learning, intelligent algorithms and use teams of mathematicians to target rising coins.

Signals are sent out directly to the users bots which purchase and offer when they get them.

Signals Dashboard

Signaler control panel where you can subscribe

The bot permits you to take advantage of booming market with a trailing stop-loss, and has full technical analysis features from Stoch and RSI to Bollinger Bands and MACD.

Cryptohopper has an extremely great contemporary control panel area where you can configure and keep an eye on whatever and includes a config wizard or pre-created design templates for the popular exchanges: Binance, Bittrex, Poloniex, GDAX and Kraken.

Cryptohopper Control panel

Traders with more experience can include their preferred technical indicators, activates and use tools that come in handy in bear markets, such as DCA & shorting functions.

Unlike numerous other bots, Cryptohopper does not charge any trading charges, and is one of the few bots to provide a free trial for a month with the ability to update to Bunny ($ 19 p/m), Hare ($ 49 p/m) and Kangaroo ($ 99 p/m).

We have actually finished an Indepth Review of Cryptohopper here.

See Cryptohopper

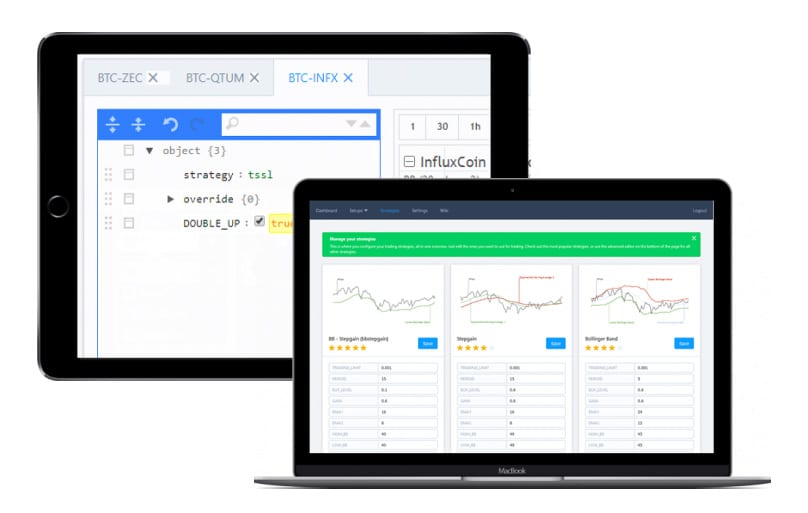

CryptoTrader : Automatic Trading Bot

The CryptoTrader bot is a cloud based trading bot that supplies users with completely automated trading options while not requiring them to install the bot on their own system.

CryptoTrader includes a methods ‘marketplace’ that permits users to purchase their preferred trading method, or alternatively to sell methods established by themselves.

Cryptotrader supports many of the significant exchanges for both backtesting and live trading, with the backtesting tool permitting users to evaluate how their strategies would work under different market conditions.

CryptoTrader uses five various membership plans, with charges varying from 0.006 BTC to 0.087 BTC each month (Bitcoin is the only payment technique accepted).

The different packages consist of a variety of distinctions, consisting of the number of bots operating on the user’s behalf along with the maximum equity limit.

Although though some understanding of coding is helpful when setting up strategies in the CryptoTrader bot, there are a variety of totally free and paid methods offered for users that are not experienced/ interested in coding.

The CryptoTrader bot likewise has a large level of interoperability, with the service offering email and text notices to alert users on crucial market occasions or changes in trends.

Haasbot: Trade Altcoins Automatically

Created in 2014 by Haasonline, Haasbot trades Bitcoin and lots of other altcoins, Although Haasbot is probably the most complete of the trading bots that are currently offered, doing much of the labour with fairly very little input required from the user, in order to offer this service it is pretty expensive, with expenses ranging from between 0.04 BTC and 0.07 BTC for a three-month period.

At those rates, it is clear that anybody going to gamble on it need to be educated about what they expect to leave the platform and be dedicated to doing so.

Visit HaasbotZignaly

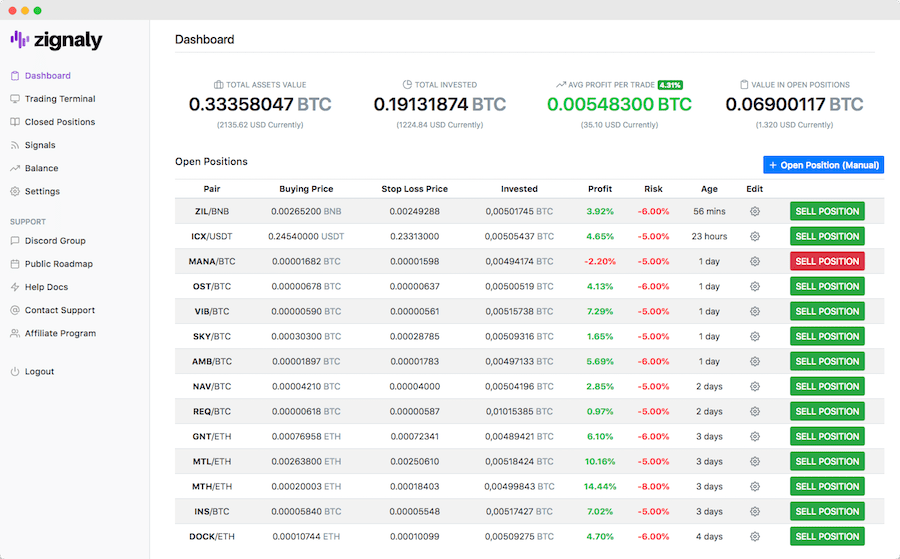

Zignalyis a trading terminal with cryptocurrency trading bots that lets you trade automatically with help from external crypto signal service providers. Zignaly is exceptionally simple to use and can be used as a passive income maker.

The platform lets you quickly get in touch with a TradingView account, so you can use it with your favorite indicators.

Alternatively, you can utilize the Zignaly trading terminal to produce your full strategy at when.

Go to Zignaly

GunBot

GunBotis a well known cryptocurrency trading bot which utilizes specific strategies that are completely customisable to fit your trading design.

It can operate on the following exchanges: Bittrex, Binance, Poloniex, Bitfinex, Cex.io, GDAX, Kraken and Cryptopia.

You can run the bot on your own computer or use a VPS and can manually include various coin pairs, choose a technique and set it to work.

Go to GunBot

Gekko: Free Automated Bitcoin Trading Bot

Gekko is an open-source trading bot and backtesting platform that supports 18 different Bitcoin exchanges. Gekko is completely free and can be found on the GitHub platform.

Gekko is a reasonably uncomplicated trading app to utilize that includes an interface and basic strategies from the beginning, which permits you to be more comfy with using the bot.

Gekko likewise has a variety of plugins readily available that will permit you to be updated no matter what level of connectivity you have.

Although Gekko is not a high-frequency trading bot (making only a number of trades per week, depending upon setup), nor a bot which permits you to make use of arbitrage opportunities, its list of supported exchanges and basic strategies indicates that it is probably a good location to begin for anyone thinking about utilizing Bitcoin trading bots.

Zenbot : Free Automatic Trading Bot

Similar to Gekko, Zenbot is likewise an open-source trading bot for Bitcoin traders. As an open-source project, Zenbot is readily available for users to download and customize the code as essential.

Nevertheless, there have actually been concern marks in the neighborhood over the development of Zenbot, with no updates having been made to the platform for a significant number of months. This suggests that no extra exchanges have been added to the platform for almost one year, meaning that it may have access to less info than a few of its competitors.

Nevertheless, on the positive side, Zenbot, unlike Gekko, does offer high-frequency trading in addition to supporting numerous cryptocurrencies in addition to Bitcoin.

Final Thoughts and Decision

Trading bots can help traders in making sure that they are constantly engaging with the market, even when they are physically unable to do so.

They can assist in getting rid of a few of the stress and emotions that are often discovered in any financial trading markets, not least the cryptocurrency market.

However, trading bots are not for everyone, nor does everybody require one.

Casual financiers are not the prime target of trading bots, and if your objective is to purchase and hold Bitcoin then a trading bot is most likely not the correct financial investment for you.

In addition, if you are not a qualified programmer or acquainted with the creation of monetary methods, trading bots may also not be for you. However, if you have the requisite understanding and capability to get rid of these obstacles then a trading bot can be a worthwhile tool in tracking and making gains from the Bitcoin market.

Recent Comments